This article highlights one such mass maintenance utility for updating Purchase orders in bulk.

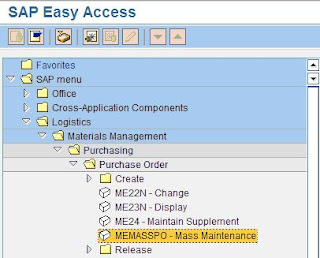

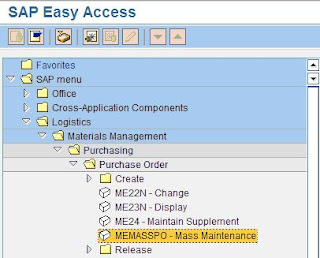

Go to T Code MEMASSPO.

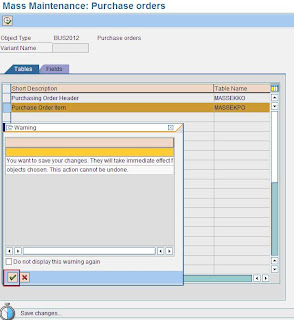

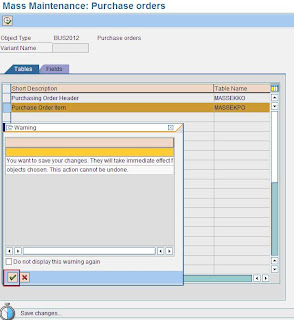

Click on SAVE.

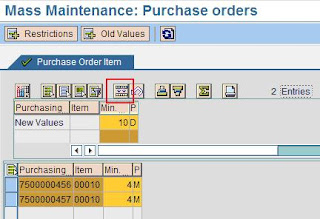

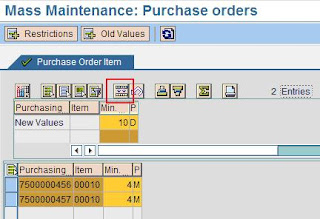

Click on the check box.

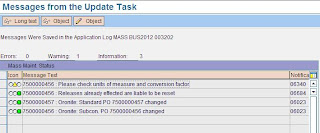

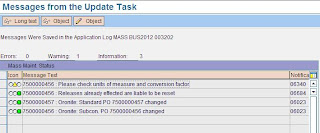

Below is the update log.

Click on SAVE.

Click on the check box.

Below is the update log.

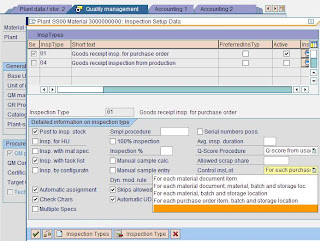

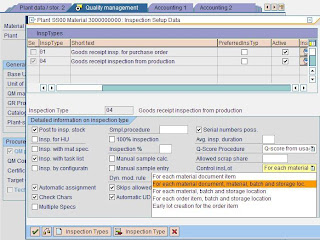

This article explains the setting required to control Inspection Lot creation for Purchase Order / Production Order or Process Order.

In the material master > QM view of the material, click on Inspection type and the following pop-up screen will open.

The following screen shows the settings for a Production Order / Process Order.

The advantage of having batch unique at material level is, the batch number remains consistent during stock transfer between different plants. Next the batch status management is activated,

The advantage of having batch unique at material level is, the batch number remains consistent during stock transfer between different plants. Next the batch status management is activated, The node “initial status of a new batch” allows to set the status as “restricted” when a new batch is created. If there is no check mark against “initial status” as shown in the figure below, the stock remains unrestricted. This setting is at material type level. The check box may not be required to be set in case Quality Management is active. With QM, the stocks are anyways inspected, so putting them into restricted would increase one more step of bringing them from restricted to quality inspection stock.

The node “initial status of a new batch” allows to set the status as “restricted” when a new batch is created. If there is no check mark against “initial status” as shown in the figure below, the stock remains unrestricted. This setting is at material type level. The check box may not be required to be set in case Quality Management is active. With QM, the stocks are anyways inspected, so putting them into restricted would increase one more step of bringing them from restricted to quality inspection stock.

Step 4 – Batch ValuationThis step is used to maintain batch characteristic values while creating batches in the background (automatically) or manually in the foreground. Batch characteristics are also useful when batch determination functionality is required during goods issue. The batch anyways inherits the material characteristics / class for which it is created.

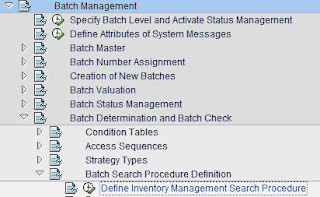

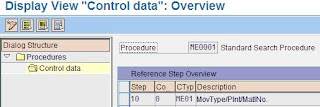

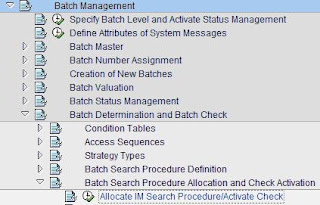

Step 4 – Batch ValuationThis step is used to maintain batch characteristic values while creating batches in the background (automatically) or manually in the foreground. Batch characteristics are also useful when batch determination functionality is required during goods issue. The batch anyways inherits the material characteristics / class for which it is created.  Step 5 – Batch DeterminationIt uses the standard sap access sequence search strategy. Over here, strategy type is like condition type in pricing. The following screen shows how to set it up.

Step 5 – Batch DeterminationIt uses the standard sap access sequence search strategy. Over here, strategy type is like condition type in pricing. The following screen shows how to set it up.

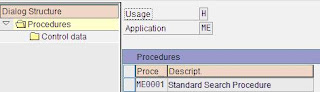

A new strategy type can be created here, preferably a copy of one of the existing strategy type. These strategy types are then used in “Batch search procedure definition” as shown below.

A new strategy type can be created here, preferably a copy of one of the existing strategy type. These strategy types are then used in “Batch search procedure definition” as shown below.

The key combination displayed above (for T Code MBC1) is as per the access sequence configured under “batch determination and batch check”.

The key combination displayed above (for T Code MBC1) is as per the access sequence configured under “batch determination and batch check”. The following screen shows how to set it up for tolerance key “PP” – Price Variance. It says that tolerance key PP is active for company code 2600 and the lower limit for tolerance is 5% and upper limit is $ 100.

The following screen shows how to set it up for tolerance key “PP” – Price Variance. It says that tolerance key PP is active for company code 2600 and the lower limit for tolerance is 5% and upper limit is $ 100. There are also situations when the invoice, though within tolerance, is entered with a large amount. It is then recommended to block the invoice to check the amount. It can also be applicable to cases when invoices do not refer to any purchase order. To activate this check, tolerance key “AN” - Amount for item without order reference and “AP” - Amount for item with order reference, need to be configured. Subsequently the following node “Activate Item Amount Check” needs to be activated.

There are also situations when the invoice, though within tolerance, is entered with a large amount. It is then recommended to block the invoice to check the amount. It can also be applicable to cases when invoices do not refer to any purchase order. To activate this check, tolerance key “AN” - Amount for item without order reference and “AP” - Amount for item with order reference, need to be configured. Subsequently the following node “Activate Item Amount Check” needs to be activated.

In the step "Activate Stochastic Block", stochastic block is activated at company code level for desired company codes. The next step is "Set Stochastic Block" and here "threshold value", "currency" and "percentage" is entered to set the stochastic block on invoices. If the invoice value exceeds threshold value, based on the percentage (probability) block will be set on the invoices. If the invoice value is lower than the threshold value, the percentage (probability) gets reduced in proportion to the invoice value and accordingly a block is set on the invoices.

Example

Threshold value: $6000 Percentage: 50

| Invoice value | Percentage or probability of a block |

$7000 | 50 % |

$8000 | 50 % |

$3000 | 25 % (= 3000/6000 * 50) |

$300 | 2.5 % (= 300/6000 * 50) |

SAP also has Industry Solutions which combine the SAP R/3 framework and application modules alongwith additional industry-specific functionalities. Special processes, techniques and modules have been developed for almost all different industry types such as oil and gas, mining, pharmaceuticals, retail, banking etc. which makes SAP relevant for all kinds of businesses.

ERP Vendors

There are several vendors which provide ERP solution. Some of the leading ones are as under,

SAP is the market leader in ERP solutions. Its closest competitor is Oracle Applications which stands as a distant second to SAP.